惠誉评级—香港/首尔/悉尼—2013年7月30日:惠誉评级已授予百度(A级/展望稳定)拟发行的美元高级无担保债券预期的‘A(EXP)’级。 此项债券的最终评级将视最后收到的文件与已获取的文件符合程度而定。此项 ...

Fitch Ratings-Hong Kong/Seoul/Sydney-30 July 2013: Fitch Ratings has assigned Baidu Inc.'s (Baidu, A/Stable) proposed USD senior unsecured notes an expected rating of 'A(EXP)'.

The final rating on the notes is contingent upon the receipt of final documents conforming to information already received. The notes' rating is in line with Baidu's senior unsecured rating of 'A'.

The proceeds from the proposed senior unsecured notes will be used for general corporate purposes, including funding potential acquisitions.

Key Rating Drivers

Dominant market position: The ratings reflect Baidu's dominance in the internet search market in China with a traffic market share of over 80%. The ratings also benefit from the company's strong profitability and balance sheet, reflecting its cash generation ability through a proven performance-based, online marketing service to half a million advertisers targeting hundreds of millions of Chinese internet users.

Strong competitive advantages: Fitch believes that technological innovation plus high levels of brand recognition and consumer satisfaction have enabled Baidu consistently to defend its high market share in a rapidly growing market. Its brand, intellectual property and market share present high barriers to entry for potential competitors. The company also has managed its relationship with the government and other regulatory bodies well.

Solid performance: Baidu's Q213 operating results remained solid with robust revenue growth of 38.6% yoy and a steady EBIT margin of 38.4% (Q113: 37%). It added 58,000 online active customers in Q213 - the highest quarterly net addition to date. In addition, the adoption of its mobile platform gained further momentum with higher mobile revenues. Mobile revenues for the first time accounted for over 10% of its total revenues in Q213.

Acquisition of 91 Wireless: Fitch believes that the acquisition of 91 Wireless, if it proceeds, will not materially alter Baidu's credit profile, but will enhance Baidu's mobile presence, create cost synergies, complement its existing mobile products and sharpen the ability to monetise mobile traffic. According to iResearch, 91 Wireless is the largest Chinese third-party applications distribution platform in terms of both active users and cumulative downloads.

Strong cash generation: Baidu generated free cash flow (FCF)/sales of around 40% for the period of 2008 to 2012 and continued to maintain a net cash position as of end-June 2013. Fitch expects Baidu to maintain strong financial flexibility with sound profitability, ample liquidity and prudent leverage over the medium term.

Foreign ownership restrictions: Chinese law restricts foreign equity ownership in internet, online advertising and employment agency companies in China. Baidu operates its websites in China through contractually controlled consolidated affiliated Chinese entities. These variable interest equity (VIE) arrangements are the usual mechanism for overseas investors to participate in China's restricted sectors and are a credit weakness as they may not be as effective in providing control as direct ownership or may face legal challenge in the future.

VIE weaknesses mitigated: Fitch takes comfort from the fact that Baidu generates over 70% of revenues from, and keeps almost all the cash and assets within, its wholly owned subsidiaries in China rather than at the contractually controlled, consolidated affiliated entities. The agency is also reassured by the alignment of Baidu's and affiliates' objectives and the company's continuing good relationship with the government and regulatory authorities.

Rating Sensitivities

Negative: Future developments that may, individually or collectively, lead to negative rating action include:

- Evidence of greater government, regulatory or legal intervention leading to an adverse change in the company's operations, profitability or market share

- Decline in operating EBIT margin to below 10% (37.8% in H113)

- Decline in pre-dividend FCF/sales ratio to below 10% (42.3% for 2012)

- Increase in funds from operations-adjusted leverage to above 2x (1.3x for 2012)

Positive: For the short-to-medium term, Baidu's rating is at its ceiling and takes into account Fitch's expectation of profit growth. The agency may consider an upgrade if the company develops businesses that materially diversify cash generation away from operations which are subject to Chinese government and regulatory risk.

监督方式防骗必读生意骗场亲历故事维权律师专家提醒诚信红榜失信黑榜工商公告税务公告法院公告官渡法院公告

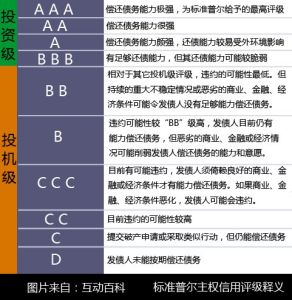

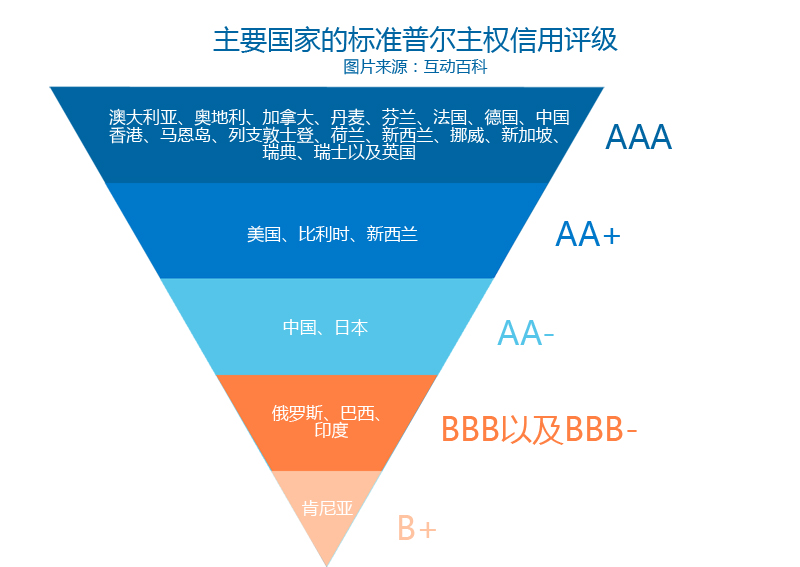

个人信用企业信用政府信用网站信用理论研究政策研究技术研究市场研究信用评级国际评级机构资信调查财产保全担保商帐催收征信授信信用管理培训

华北地区山东山西内蒙古河北天津北京华东地区江苏浙江安徽上海华南地区广西海南福建广东华中地区江西湖南河南湖北东北地区吉林黑龙江辽宁西北地区青海宁夏甘肃新疆陕西西南地区西藏贵州云南四川重庆