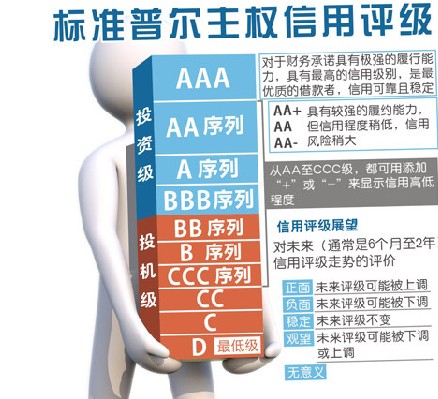

惠誉评级—香港/悉尼—2013年8月16日:惠誉评级表示,预期中国移动有限公司(中国移动,A+级/展望稳定)收入增长和盈利能力将受到其它电信公司和OTT运营商带来的更激烈竞争的影响。虽然我们预期3G服务在2013年上 ...

Fitch Ratings-Hong Kong/Sydney-16 August 2013: Fitch Ratings says it expects China Mobile Limited's (CML, A+/Stable) revenue growth and profitability will be affected by higher competition from other telecoms companies and over-the-top (OTT) operators. While we expect the growth in 3G services seen in H113 to continue, operating cash flow will be broadly stable as newer services are generally less profitable than legacy operations. Nevertheless, EBITDA, cash generated and liquidity will remain strong.

CML's 3G business will continue to gain traction, with 3G network utilization continuing to improve. Fitch estimates that CML's 3G revenue surged 96% yoy to CNY52bn in H113, offsetting the decline in voice revenue and short message service (SMS) revenue due to heightened competition and data for voice substitution.

However, Fitch expects CML to continue to gradually lose subscriber and service revenue market shares over the next two to three years. In addition, Fitch forecasts that CML's revenue growth will slow, and profitability will remain under pressure due to intensifying OTT substitution. In H113, CML still received 69% of its revenue from traditional voice and SMS services, which tend to command higher margins but have higher substitution risk.

Over the next two to three years, we expect CML's EBITDA, at best, to remain stable despite mid-single digit per annum revenue growth, as margins will continue to decline. Excluding the effect of a reclassification of handset sales, CML's EBITDA margin was 43.4% in H113, compared to 46.2% in H112. Nevertheless margins remain strong when compared to global peers.

Fitch believes an accelerated licensing and increased government support of CML's 4G time division long-term evolution (TD-LTE) technology will help reduce CML's disadvantages in mobile data. CML's 3G business continues to be hindered by the inferiority of its time division synchronous code multiple access (TD-SCDMA) technology compared to competitors' global 3G technologies, and the company has been losing some high- to middle-end mobile subscribers. On 8 August 2013, China's State Council issued new guidelines to fast-track information technology related consumption, including targeting 4G licensing by the end of 2013 and the promotion of TD-LTE.

监督方式防骗必读生意骗场亲历故事维权律师专家提醒诚信红榜失信黑榜工商公告税务公告法院公告官渡法院公告

个人信用企业信用政府信用网站信用理论研究政策研究技术研究市场研究信用评级国际评级机构资信调查财产保全担保商帐催收征信授信信用管理培训

华北地区山东山西内蒙古河北天津北京华东地区江苏浙江安徽上海华南地区广西海南福建广东华中地区江西湖南河南湖北东北地区吉林黑龙江辽宁西北地区青海宁夏甘肃新疆陕西西南地区西藏贵州云南四川重庆