惠誉评级—新加坡/悉尼—2013年7月17日:惠誉评级表示,随着中国政府让经济转型走上正轨,即使目前宏观经济数据偏弱,该机构仍然预期其所评的中资工业企业将保持良好业绩。惠誉预期中国经济到2015年年均增长为7% ...

Fitch Ratings-Singapore/Sydney-17 July 2013: Fitch Ratings says that it expects its portfolio of rated Chinese corporates to remain in good shape as the authorities allow rebalancing to run its course, notwithstanding the recent tide of weak macro-economic data. Fitch expects the Chinese economy to grow 7%-7.5% out to 2015.

Fitch believes that China's new leadership is keen to ensure that rebalancing of the world's second-largest economy - more towards consumption and away from infrastructure and real estate projects that may not help economic growth in the long term - gets off to a solid start in 2013. The combination of tighter liquidity in the Chinese financial markets and the government's refusal so far to provide any new stimulatory measures, notwithstanding recent weak macro-economic data, leads Fitch to this view.

Such rebalancing did not occur during 2012 - fixed investment as a share of GDP rose to 46.1% in 2012 from 45.6% in 2011, whereas household consumption was more or less flat at 35.7%. Fitch envisages that progress on China's rebalancing will be slow and uneven over a long time frame, and hence investment activity will still remain substantial in the short term. The prospect of China's economy continuing to grow at or above 7% p.a. out to 2015 as the rebalancing occurs is supported by current favourable dynamics in the Chinese labour market where demand for jobs continues to exceed supply.

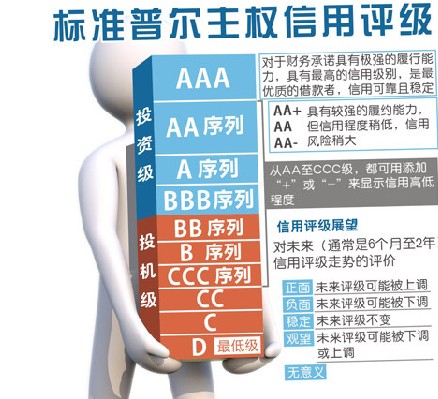

Fitch expects large players in the housing and cement sectors to perform better within their industry and to register higher profits in 2013 than in 2012, notwithstanding the government's focus on rebalancing. The leading homebuilders, including China Overseas Land & Investment Limited (BBB+/Stable), China Vanke (BBB+/Stable) and Poly Real Estate Group (BBB+/Stable), will benefit from larger scale urban redevelopment projects and the large cement companies, including Anhui Conch Cement, are likely to lead consolidation in their sector. However, the steel industry will continue to see razor-thin profit margins amid persistent industry over-capacity.

Over the medium term, urbanisation will actually help rebalancing from two perspectives: greater demand for higher value-added goods and services and a gradual retrenchment of polluting heavy industry capacity away from urban areas as new housing developments take over.

The overall Chinese non-financial corporate sector is holding up in the face of strong headwinds, particularly anaemic global economic growth. While yields on USD Asian corporate bonds, as represented by the corporate JP Morgan Asia Credit Index, have increased 65bp to 5.6% since the beginning of June, Fitch believes this is more due to the rise in US treasury yields, rather than specific concerns at China's corporates.

Total profits for China's industrial enterprises during the first five months of 2013 increased by a respectable 12.9% yoy, according to China's National Bureau of Statistics. Profits for China's state-owned enterprises only increased 2.9%, but profits for the remaining enterprises increased 17.3%.

Specifically on the consumption front, during H113 total retail sales were up by 15% yoy and total passenger car sales were up 14% yoy. However, Fitch believes auto sales growth may decelerate in H2 due to additional car purchase restrictions and if the macro environment weakens further.

On the investment front, large homebuilders in China continued to report improving contracted sales growth in H113 over H112 and housing area under construction grew 16.8% in 5M13. Long-term contracted sales growth remains supported by strong housing demand, even if weaker sentiment over China's economic growth may slow housing sales growth in H213. However, Fitch believes any such negative short-term impact will be temporary and unlikely to persist for more than three quarters.

Cement production grew 8.9% in 5M13 as real estate investment growth continued to support demand. Market expectations of stronger infrastructure investments in H213 over H113 have been supporting continued production growth.

Chinese steel production during the H1 period grew by 9% yoy but value growth was negative due to weaker prices. The contract price of Shanghai steel fell to a new low of CNY3,150/ton in early July on weaker coke prices. Lower raw material prices should improve Chinese steel mills' profitability compared to last year, which will further be supported by steady H213 volumes and a low base effect in H212. However, with Beijing currently not prepared to introduce new stimulatory measures, this rate of growth is not sustainable and Fitch expects growth rates to be closer to 5% beyond 2013.

监督方式防骗必读生意骗场亲历故事维权律师专家提醒诚信红榜失信黑榜工商公告税务公告法院公告官渡法院公告

个人信用企业信用政府信用网站信用理论研究政策研究技术研究市场研究信用评级国际评级机构资信调查财产保全担保商帐催收征信授信信用管理培训

华北地区山东山西内蒙古河北天津北京华东地区江苏浙江安徽上海华南地区广西海南福建广东华中地区江西湖南河南湖北东北地区吉林黑龙江辽宁西北地区青海宁夏甘肃新疆陕西西南地区西藏贵州云南四川重庆