惠誉评级—香港/新加坡—2013年8月2日:惠誉评级已授予保利财务有限公司发行的5亿美元、票息4.5%的担保债券最终的‘BBB+’级。此项债券由恒利(香港)置业有限公司(恒利置业)——保利房地产(集团)股份有限公 ...

Fitch Ratings-Singapore/Hong Kong-02 August 2013: Fitch Ratings has assigned Poly Real Estate Finance Ltd.'s USD500m 4.5% guaranteed notes a final 'BBB+' rating. The notes are unconditionally and irrevocably guaranteed by Hengli (Hong Kong) Real Estate Limited (Hengli), a wholly owned subsidiary of Poly Real Estate Group Company Limited (Poly, BBB+/Stable).

In place of a guarantee, Poly has granted a keepwell deed and a deed of equity interest purchase undertaking to ensure that the guarantor, Hengli, has sufficient assets and liquidity to meet its obligations under the guarantee for the USD notes. Furthermore, Poly's parent, China Poly Group Corporation (China Poly), has also granted a keepwell deed to Poly and Hengli to ensure Poly has sufficient assets and liquidity to meet its obligations under the keepwell and undertaking deeds; and that Hengli has sufficient assets and liquidity to meet its obligations under the guarantee for the notes.

The final rating is in line with the expected rating assigned on 13 June 2013, and follows the receipt of documents conforming to information already received.

KEY RATING DRIVERS

Parent support benefits ratings: Poly's ratings benefit from a one-notch uplift reflecting strong operational and strategic linkage with its parent China Poly, in accordance with Fitch's "Parent and Subsidiary Rating Linkage" criteria. China Poly's support to Poly is evidenced by significant funding support to Poly, including providing a keepwell deed for Poly's offshore debt issues.

Poly is a core subsidiary of China Poly as its strong growth has enabled the latter to become the largest homebuilder among 16 enterprises wholly owned by state-owned Assets Supervision and Administration Commission of the State Council, which has property as one of its core businesses. The parent support, however, does not raise Poly's ratings above the 'BBB+' level - which is the highest in China's homebuilding industry - as it is not sufficient to offset industry risk.

Leading Chinese homebuilder: Poly is one of China's top three homebuilders by contracted sales value and its operation is sufficiently diversified across 43 cities, with over 90% of its sales from tier-one and tier-two cities in 2012. Poly also ranks among the top three homebuilders in 18 cities. Its large scale gives it strong operational and financial flexibility.

Strong branding supports growth: Poly is one of the best performers among the top ten Chinese homebuilders. Its contracted sales have seen a compounded annual growth rate of 51.5% since 2006 compared with China Vanke Co., Ltd's (Vanke, BBB+/Stable) 37.2% and China Overseas Land & Investment Limited's (COLI, BBB+/Stable) 34.3%. This is partly due to its established branding which focuses on delivering comfortable housing at affordable prices.

Diversified funding channels: Poly has tapped funding from multiple channels to improve financial flexibility. Quasi-equity-like real estate funds taking minority stakes in Poly's projects and new equity private placements have raised CNY27bn of capital for Poly since 2006. Tapping the domestic capital market and obtaining shareholders' loans from China Poly provide Poly with additional sources of funding apart from bank borrowings.

Aggressive growth drives leverage: Constraining Poly's 'BBB' standalone rating is its high leverage arising from recent rapid growth. Poly has expanded aggressively since 2006; net property assets grew to CNY105bn in 2012 from CNY6bn in 2006. As a result, leverage as measured by net debt/adjusted inventory rose to a high of 63% in 2010 before falling to 46.5% in 2012 as growth moderated. Poly's growth since 2006 has been supported by CNY44.9bn of net debt increase and CNY8.4bn minority shareholders' equity injection.

Stable operation drives outlook: Fitch expects Poly to retain its leadership in the Chinese homebuilding market. Its focus on mass market home buyers and its operational and financial flexibility should help maintain moderate growth in a highly competitive and cyclical Chinese property market.

Keepwell deeds not guarantees: Poly does not provide a guarantee to offshore subsidiaries given the difficulties of obtaining approval from the State Administration of Foreign Exchange, more commonly known as SAFE. However, both the keepwell deeds and Poly's undertaking deeds signal a strong intention from Poly and China Poly to honour its proposed debt obligations.

监督方式防骗必读生意骗场亲历故事维权律师专家提醒诚信红榜失信黑榜工商公告税务公告法院公告官渡法院公告

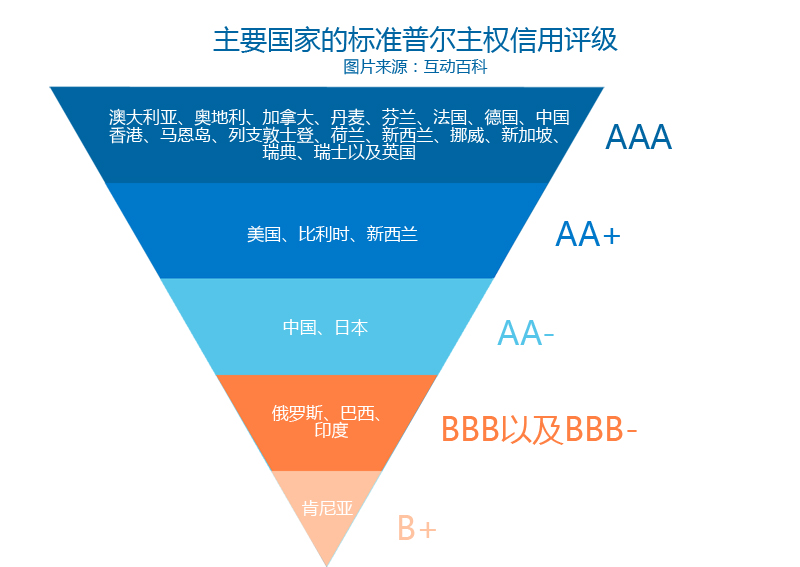

个人信用企业信用政府信用网站信用理论研究政策研究技术研究市场研究信用评级国际评级机构资信调查财产保全担保商帐催收征信授信信用管理培训

华北地区山东山西内蒙古河北天津北京华东地区江苏浙江安徽上海华南地区广西海南福建广东华中地区江西湖南河南湖北东北地区吉林黑龙江辽宁西北地区青海宁夏甘肃新疆陕西西南地区西藏贵州云南四川重庆